Financial Wellness: Understanding Its Impact on Mental Health

To kick off National Suicide Prevention Awareness Month, we’re going to talk about the state of financial wellness and how it affects our mental health. This is the first part of a six-part series called the “State of Personal Finance.” Over the next few articles, we will delve deep into the financial landscape of the United States, exploring the challenges, opportunities, and tools available to individuals. Our goal is to provide a comprehensive understanding of the current financial climate and offer actionable insights to help navigate these complex waters.

The Connection Between Financial Health and Mental Well-being

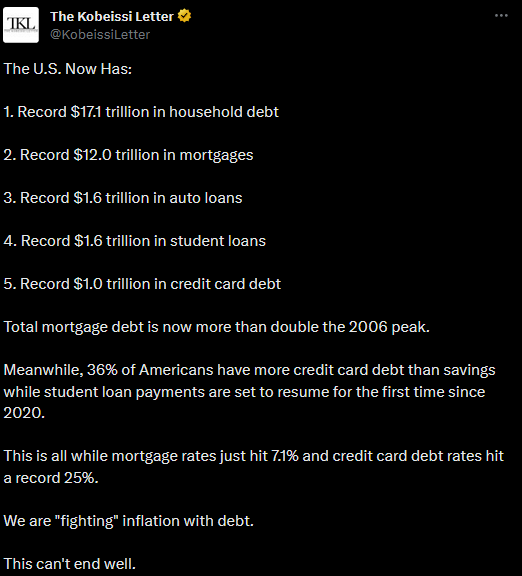

The financial health of a nation is often reflected in the financial well-being of its citizens. As we step into this series, it’s essential to understand the broader picture. A recent tweet by The Kobeissi Letter highlighted the staggering household debt in the U.S., which has reached a record $17.1 trillion. Such figures are alarming, especially when juxtaposed with the fact that 34% of U.S. adults feel they are “just getting by financially.”

Such figures are alarming, especially when juxtaposed with the fact that 34% of U.S. adults feel they are “just getting by financially.”

Utilizing Tools and Resources for Financial Wellness

In this age of information, we have more tools and resources at our disposal than ever before. From budgeting apps like Rocket Money and Mint to financial coaching offered by local municipalities, the avenues to financial literacy are vast. Schools are even incorporating financial education into their curriculum. So, the question arises: With all these resources, why is there still a significant gap in financial wellness?

While there are numerous factors at play, this series will focus on the human element of personal finance. It’s one thing to have knowledge, but applying it is a different ball game. Financial literacy is not just about knowledge but about behavior, mindset, and personal experiences.

Upcoming Topics in the Series

As we progress through this series, we will delve deeper into various facets of personal finance:

- The U.S. debt situation and its implications

- The true essence of financial literacy

- The intricate relationship between finances and mental health

- Why employers should be concerned about their employees’ financial well-being

- And finally, actionable steps to kickstart your financial wellness journey.

Whether you’re struggling with debt, looking to enhance your financial knowledge, or seeking ways to improve your employees’ financial health, this series has something for everyone. So, please continue reading and follow as we talk about financial wellness in the US.

You can also learn more with us by checking out VectorGoals.com